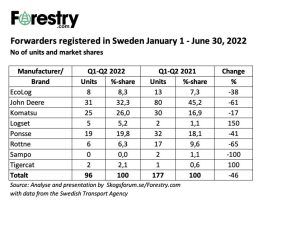

The Nordic manufacturers of forest machinery struggle with major problems in their supply chain. The lack of components makes the number of registered* forwarders on the Swedish market go down dramatically. For some of the major manufacturers, we are talking about a 50 percent decrease in delivered machines during the first six months of 2022 compared to 2020 and 2021. We must go back to the times after the crisis in 2009 to find corresponding figures.

Lack of components stops forwarder deliveries – different strategies

The current situation is frustrating for the manufacturers to say the least. Orders for new machines are still floating in, but deliveries are delayed due to missing components. Komatsu Forest has decided to keep the production going at a normal pace in the new factory in Umeå, northern Sweden. Maybe they don’t want to lose time in the fine-tuning of the new production line.

The result is that many machines are undeliverable until a few last components are added to them. The area around the factory looks like a parking place at the mall on a Friday afternoon – with only Komatsu machines.

Photo: Torbjörn Johnsen

Other manufacturers, like Ponsse in Finland, have started negotiations with the staff about downsizing the production. One reason that has been mentioned, is the current situation in Russia, Belarus, and Ukraine. But one can guess that the lack of components contributes to the bad situation. Ponsse alone has lost 40 percent of its registered forwarders during the first six months of 2022 compared to the same period in 2021. Something that hints that the desired production pace can’t be maintained.

A light in the tunnel?

For some types of components, the situation seems to brighten, at least a bit. The steel prices have reached their peak and the desired qualities are available again. Also for hydraulic components, it slowly looks better, but the problems with semiconductors are still there.

The question is if the machine manufacturers will manage to get the production speed up before the next recession. That is if the recession will strike in the forest?

The wood flow decides

The main factor that affects the Swedish forest machine market, is the wood flow to the industry. The more forest that felled the more machines are needs to be traded for new ones. For the moment the felling volumes in Sweden are at an all-time high. Official figures show records in both felling and industry production. The prices for both lumber and pulp are good, and the profitability of the forest industry is still brilliant.

Despite warnings of decreasing profitability, the crise levels are still far away. We will see what the absence of Russian timber in important markets will do. And if the increased interest in carbon storage in the forest will compensate for raising interest rates and a coming recession.

Pointless market analysis

Under the current circumstances, there is no point in analyzing the Swedish forwarder market. Very few delivered machines in a situation of an intensive component hunt, making the market look like a gaming hall. It’s coincidental whether you get machines out on the market or not.

Here below are the hard facts.

* In Sweden, all forwarders are registered by the Swedish Transport Agency (Transportstyrelsen) at delivery. As the Swedish market for CTL** machines is the largest in the World (2021), those figures give a pretty good picture of the total market for CTL machines. The harvesters are not registered by the Transport Agency, but the number of manufactured harvesters follows the number of forwarders in most cases.

This article is based on figures from the Swedish Transport Agency’s forwarder registrations and has been analyzed and compiled by Skogsforum.se.

** CTL = Cut-To-Length is a system based on two machines: one harvester that falls and cuts the trees into lengths at the stump in the forest, and a forwarder that brings the timber to the roadside. This is the type of machine that is manufactured and used in the Nordic Countries. The CTL technology is gaining market share globally and is today used in more than half of the World´s felling operations. Most manufacturers of CTL machines are in Sweden and Finland.